- Instead of succumbing to impulsive spending or letting your paycheck slip through your fingers, consider adopting a strategic approach that ensures financial security and enjoyment.

Payday is a time of relief and anticipation. With the arrival of your hard-earned income, it's essential to make wise choices that align with your financial goals and personal well-being.

Instead of succumbing to impulsive spending or letting your paycheck slip through your fingers, consider adopting a strategic approach that ensures financial security and enjoyment.

Firstly, prioritize topping up your emergency fund. Life is unpredictable, and having a cushion to fall back on is crucial. Allocate a portion of your income towards this fund, as it will protect you from unexpected expenses and provide peace of mind.

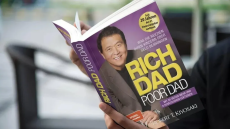

Next, seize the opportunity to make deposits into your investments. Investing is a powerful tool for growing your wealth over time. Whether it's stocks, bonds, mutual funds, or other avenues that align with your financial objectives, consistently allocating a portion of your paycheck towards investments can yield significant long-term benefits.

Ensuring the roof over your head is secure should be another priority. Pay your mortgage or rent promptly, as this guarantees housing stability and helps maintain a positive credit history.

Additionally, actively work towards reducing any high-interest debt. Such debt can be a financial burden that hampers your long-term financial goals. By prioritizing the repayment of debts with the highest interest rates, you save money in the long run and free up your future income.

When it comes to paying bills, prioritize the important ones first. This includes utilities, insurance premiums, and loan repayments. Staying current on your financial obligations helps you avoid late fees and maintain a solid financial standing.

Of course, taking care of your basic needs is essential. Allocate a portion of your paycheck towards grocery shopping, ensuring you have a well-balanced and nutritious diet. Nourishing your body is an investment in your overall well-being.

Finally, allocating a portion of your income towards personal enjoyment is essential after fulfilling your financial responsibilities. Treat yourself within reason. Whether dining out, purchasing something you've been eyeing, or saving up for a future experience, balancing financial responsibility and small rewards enhances your overall well-being.

Find the balance that aligns with your financial goals and personal values. Maximize your payday, and let it propel you towards a brighter economic future.

-1772102940-md.jpg)

-1772090413-1772095461-md.jpg)

-1772102940-sm.jpg)