- This includes exemptions from Value-Added Tax, Excise Duty, Import Duty, and Import Declaration fees.

Long-term investors can look forward to even more benefits.

In a significant move to boost economic growth, the Kenyan government has rolled out a series of financial incentives for businesses setting up in the Nakuru Economic Zone.

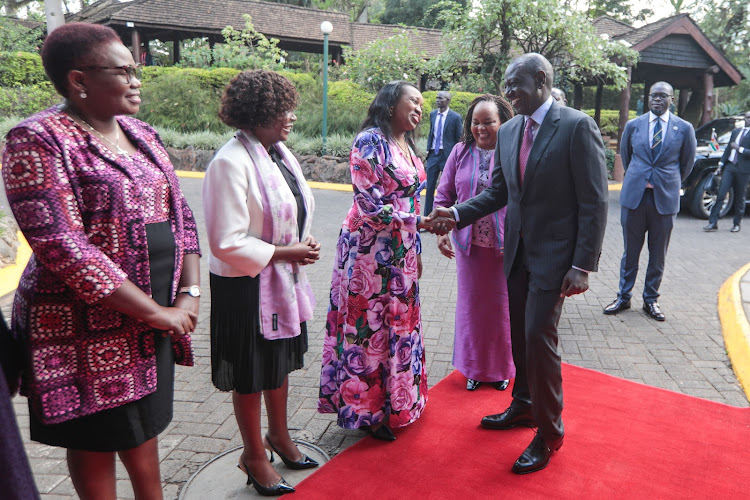

During an event in Naivasha on January 13, 2024, President William Ruto, alongside Deputy President Rigathi Gachagua and other officials, unveiled these enticing offers.

The Special Economic Zones Authority has confirmed that investors will benefit from substantial tax breaks on local and imported goods.

This includes exemptions from Value-Added Tax, Excise Duty, Import Duty, and Import Declaration fees.

In a bid to attract more investment, the government has introduced a reduced Corporate Tax rate for profits earned within the economic zones.

Read More

This preferential rate is significantly lower than the standard rate applied to businesses operating outside these zones.

Highlighting the government’s commitment, President Ruto personally awarded an operation license to an investor at the Naivasha Special Economic Zone, signaling the start of a new era of investment opportunities.

Long-term investors can look forward to even more benefits.

After a decade of operation, a new Corporate Tax rate of 15 percent will be implemented for the following ten years, before adjusting to the standard 30 percent rate.

In a forward-looking statement, the government has also proposed a reduction of the national Corporate Tax rate from 30 percent to 25 percent in the next fiscal year.

Moreover, businesses in the Nakuru Economic Zone will enjoy access to electricity at a reduced rate of Ksh 5, along with exemptions from county government business permit fees.

These incentives mark a strategic effort by the Kenyan government to position the Nakuru Economic Zone as a prime location for both local and international investors, promising a more cost-effective and profitable business environment.